Salary Benchmarking for Specialist Sectors: An Expert Guide

It's certainly been a challenging start to the year for many businesses and professionals alike. There continues to be economic uncertainty, rising employment costs, and a more cautious hiring market. Consequently, salary benchmarking has never been more important. In 2026, understanding what constitutes a fair, competitive salary is a strategic necessity.

At Swarm Recruitment, we've launched our salary benchmarking guides for specialist sectors. Each expert guide is designed to help both employers and job seekers navigate a complex landscape with confidence. Starting with Marketing Salary benchmarking in January, followed by Financial Services Salary benchmarking in late January, our goal is simple: to bring clarity, transparency, and realism to pay expectations in specialist hiring.

In this article, we'll explain why we created our salary benchmarking resources, how they can support smarter decisions, and what the state of the UK job market in 2026 means for salaries, hiring, and long-term strategies.

Why We Created Our Salary Benchmarking Guides

Since the pandemic, we have seen a growing disconnect between salary expectations, budget constraints, and market reality, especially in specialist sectors like marketing and financial services.

From conversations we have had with businesses and candidates alike, several challenges kept coming up:

Businesses unsure whether they’re overpaying or underpaying

Candidates unsure how to position themselves realistically

Rising costs putting pressure on hiring decisions

Limited availability of reliable, sector-specific salary data

Generic salary surveys often don't reflect the nuances of specialist roles. After all, titles can mean very different things from one organisation to the next. Additionally, regional and sector-specific differences are often overlooked.

That's why we created an expert guide for these specialist sectors. They are grounded in real hiring activity, real job specifications, and real conversations.

The Job Market in 2026

The UK job market in 2026 is best described as cautiously active but cost-sensitive.

While unemployment figures remain relatively stable (5.1% in November 2025 - according to the ONS), hiring demand has softened across many sectors. Employers are hiring, but more selectively. At the same time, job seekers are facing:

Fewer advertised roles

Longer hiring processes

Increased competition for specialist positions

Businesses are facing pressure from multiple angles. For example, the National Minimum Wage is set to rise again in April 2026. Likewise, higher employer National Insurance contributions and operational costs mean that every hire carries a greater financial burden.

If you are not up to speed with these changes, you can find full details on the UK Government's website here.

Meanwhile, organisations are being asked to do more with smaller teams. This makes salary benchmarking essential, not just for budgeting, but for productivity. Every employee needs to deliver and offer long-term value.

Salary Benchmarking for Marketing and Finance Roles: Why it Matters

1. Attracting the right talent

In specialist markets, underpaying rarely saves a business money. Candidates with 'in-demand' skills have options, even in a tighter job market. After all, they are the most productive employees, providing a higher return on investment (ROI) for their employers.

Accurate salary benchmarking helps businesses:

Stay competitive without overspending

Align offers with real market expectations

Reduce failed hires due to mismatched pay

Without benchmarking, companies risk either missing out on top talent or stretching their budgets unnecessarily.

2. Retaining High Performers

Retention is often more cost-effective than recruitment. Replacing an experienced employee can cost far more than adjusting their salary to reflect market value. Consider the cost of a recruitment campaign, training, and a lower ROI initially because of a lack of experience.

Salary benchmarking allows employers to check existing pay structures and address potential issues before they lead to disengagement.

3. Giving Job Seekers Confidence and Clarity

Often, candidates feel uncomfortable about discussing salary, especially when the market feels uncertain. Our Marketing and Financial Services salary guides help job seekers:

Understand what their skills are worth in 2026

Avoid over-selling or under-selling themselves

Enter negotiations informed and confident

Naturally, it is important to note that our salary benchmarking guides provide direction, not guarantees. Individual circumstances, such as company size, location, performance expectations, and growth potential, each play a role too.

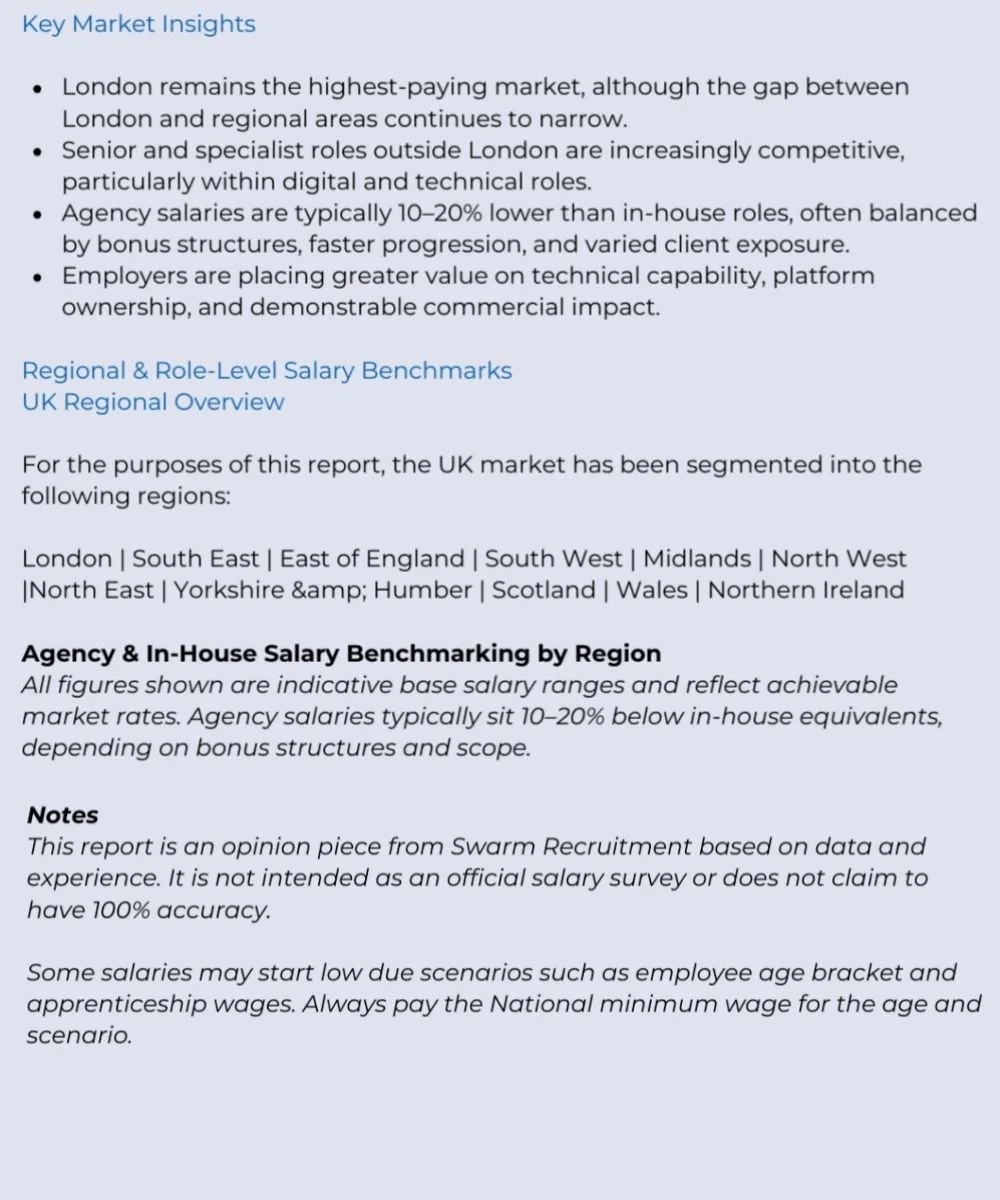

Marketing Salary Benchmarking: Launched January 2026

Marketing roles have evolved rapidly over the last decade, but salary data hasn't always kept up with the pace.

From performance marketing and customer relations management to content strategists and senior marketing leaders, we've witnessed:

Increased demand for measurable commercial impact

Greater emphasis on data, automation, and ROI

Wider salary variance depending on skill depth

Our Marketing Salary Benchmarking Guide reflects these realities, offering insight into:

Entry-level through leadership roles

Specialist skill premiums

Differences between in-house and agency roles

Financial Services Salary Benchmarking: Launched Late January 2026

Financial services continue to be a highly specialised, regulated and competitive market. Consequently, benchmarking salaries in this sector is particularly important due to:

Compliance and regulatory expertise requirements

Scarcity of experienced professionals

Increasing pressure on risk, governance, and operational efficiency

Our Financial Services salary benchmarking aims to reflect the true market value of these roles, not outdated assumptions.

Our Advice: Pay Fair, Expect Fair

Successful organisations don't aim to pay the minimum amount they can get away with to their employees. So always pay a fair wage and expect a fair wage. If you are a business owner, for example, it is often worth paying an extra 10% - 20% (or more) if you believe a candidate can deliver significantly more value over time.

The reality is that:

The best employees often produce multiple times more output

Experienced professionals can reduce risk, mistakes, and time-to-impact

Strong hires can elevate entire teams

A seasoned, proven professional may cost more upfront, but in many cases, it’s a strategic investment rather than an expense. So, our advice is to go for the very best candidates that you can afford.

Use Benchmarking As A Strategic Tool

A point to note: salary benchmarking shouldn't be read as a static document. The most effective organisations use it as an ongoing reference point to:

Inform workforce planning

Support internal pay reviews

Guide promotion and progression frameworks

Strengthen employer branding

In a market like 2026, where margins matter and people drive performance, benchmarking is a tool that should be used for sustainable growth.

Conclusion

The hiring market in 2026 is all about making smarter, more informed decisions.

For businesses, salary benchmarking provides clarity, confidence, and control in an increasingly complex employment landscape.

For job seekers, it offers reassurance, realism, and a stronger position at the negotiating table.

As specialist marketing and financial services recruiters, we believe transparency benefits everyone. Our salary benchmarking guides are designed to support conversations, better hires, and better long-term outcomes.

Whether you are building a team or planning your next move, salaries should be your starting point, not an afterthought. Why not work with us here at Swarm Recruitment for the very best outcomes?